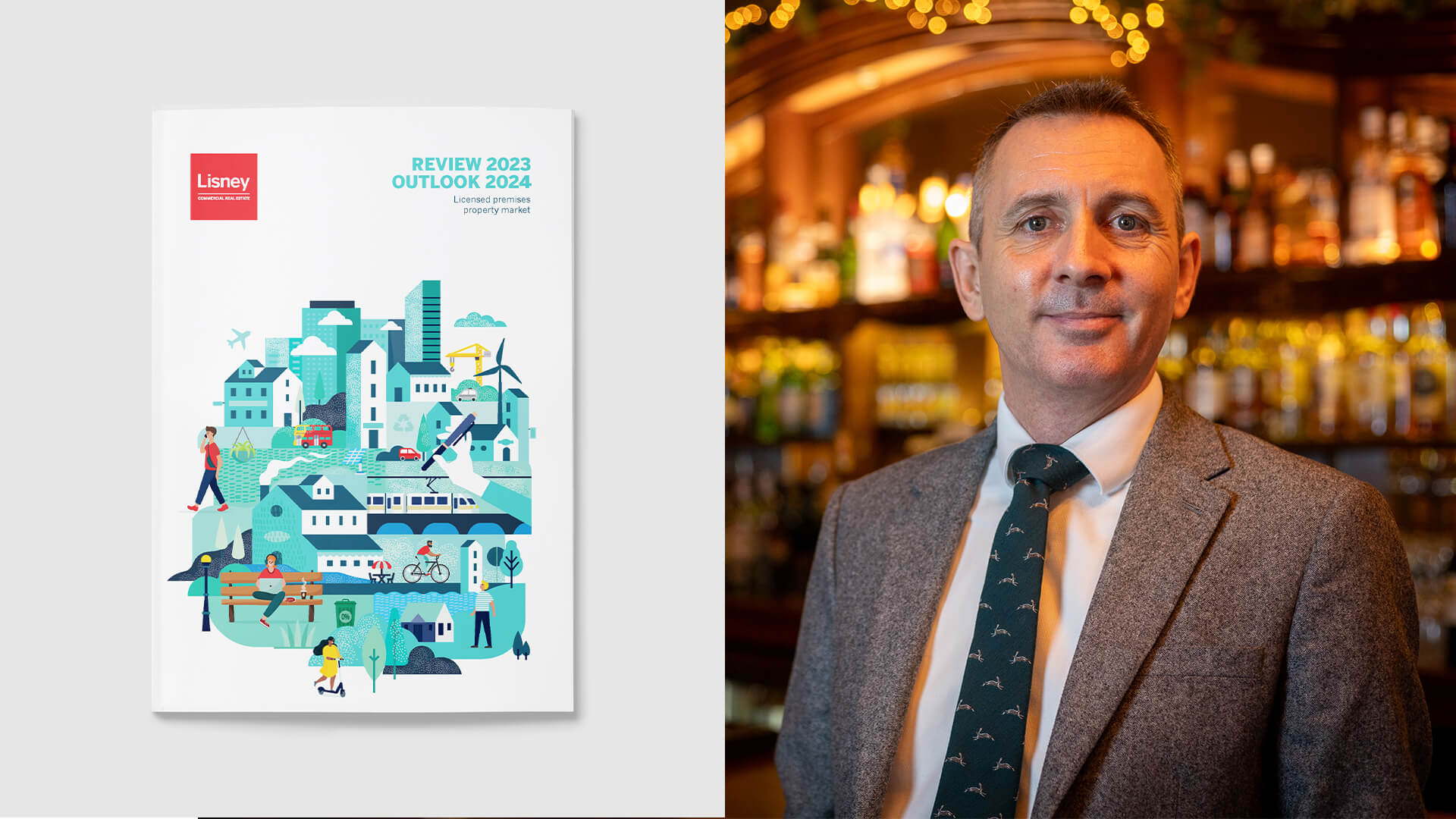

Licensed & Leisure Market Review 2023 & Outlook 2024

16th February 2024

Demand for Licensed Premises remained strong in 2023 both in Dublin and the larger regional Cities. 21 pubs changed hands in the Dublin market with a combined value in the order of €50m. Almost 30% of transactions completed were for sums north of €3m. Over 50% of transactions completed were in the €1m to €3m bracket.

At the close of 2023, 2 Licensed premises were exchanged with a further 9 at contract stage. Off-market transactions remained a feature representing almost a quarter of all sales completed. Publicans remained the dominant purchaser class accounting for 70% of sales.

Private Equity remained active in consideration of opportunities, however, didn’t complete any acquisitions for a variety of reasons.

Moving into 2024 appetite to acquire remains strong. Trading challenges however remain. Increases in the minimum wage coupled with the recent vat increase on food sales will impact upon profitability.

We see publicans remaining the dominant purchaser profile in 2024 with developers likely to be inactive as site values remain behind existing use value due to construction and finance costs.

Private Equity will continue to focus on the upper tier of the market, targeting city centre opportunities enjoying high levels of bottom-line profit.