Don’t Mention The Word: The Fundamental Shift in Ireland’s Industrial Market

21st October 2019

Across the island, Ireland’s warehouse market is seeing a fundamental change, considering both changes abroad and at home.

You would be forgiven for assuming that the Irish and Dublin industrial property market is booming when you just Google the articles and research available. There is an insatiable appetite for industrial investments, particularly from the institutional investors such as IPUT, Irish Life, Friends First etc. but this is only for absolute grade-A shiny nailed-on investments with 10-plus year income to a top-class covenant. This is your pension money looking for a home. In other, smaller industrial investments on offer, there is good demand from private investors preferring to purchase industrial rather than retail or residential investments as they can be more straightforward and easier to manage.

The occupier market, however, of vacant industrial space that is on the market either for sale or to let has seen record take-up year-on-year, quarter-on-quarter at times over the last 4-5 years. This has seen a significant reduction in Q3 2019 which is mainly related to lack of supply and uncertainty. But within this market we would see a fundamental change in warehouse space and where the demand is coming from. The owner occupier market is very active up to the €1m price bracket, where companies who have some cash can easily purchase premises of 300 to 1,000 sq. m. with bank funding to allow their business to grow, open new branches, take on new contracts etc. It is all the more active due to the large increase in rents during this time. In particular, many 5-year leases taken in 2014 are coming up for renewal or rent review. Many tenants find themselves in the position where their rent is doubling from 2014 to 2019 market rent, and if they do their figures their repayments on a mortgage are less per month. This is where we see the trend of lease renewals and rent review negotiations turning in to sales despite the recent unwise government increase in stamp duty from 6% to 7.5% on commercial property transactions. If they really wanted to do something positive that would probably bring in more revenue, they should reintroduce the former roll over relief for companies that sell their property connected with their business and put the amount in to a new premises without any capital gains tax accruing. This would put money into small business who can invest in their companies.

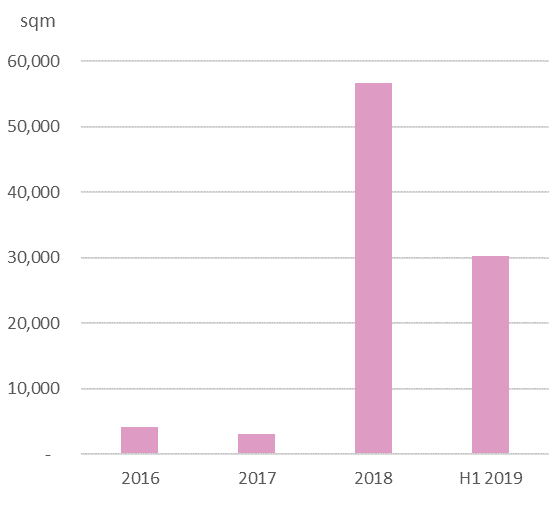

The mid-range bracket of 1,500 to 2,500 sq. m. has seen a surprising subdued demand, particularly to purchase over the past few years. We believe this is due to potential purchasers being cautious in borrowing money and have preferred to lease. In fact, the larger the industrial building the easier it has been to let. This is borne out by the new units that have been constructed and occupied since 2016. The majority of these transactions have been to lease and the average size has been 5,000 sq. m.

Many small-to-medium sized companies are faced with a few questions: 1. Do we borrow considerable money to invest in new premises to purchase?; 2. Do we take on a long term commitment to lease? or 3. Do we outsource our warehousing and distribution to a third party and stay where we are or move in to office space? These decisions are what have fuelled the larger size demand in the market from third party logistics providers, and looks like this is a fundamental shift. Where businesses make the decision not to grow by investing in new building, hence the demand for larger industrial premises is coming from the logistics providers such as DHL, Primeline, Kuehne & Nagel, Masterlink, TPN etc.

From the developers’ and builders’ points of view, the rising cost of construction, increased energy ratings requirements and certification of the building materials makes building industrial units below 1,000 sq. m. expensive and the prices or rents required are not available in the market. Therefore, the economies of scale can only be generated by building larger buildings.

So far, we have managed not to mention that other ‘word’, but we all hope that the thought of it is worse than the actuality if and when we get there. Goods have to come in and out of the country and the main shipping lines are already using more direct sailings from the continent. This has been the trend anyway and the current situation will only bring this on more and the reduction in roll on roll trucks was well on its way already, in favour of containerised movement.

Dublin Port are implementing their master plan for both the existing port area and the development of Dublin Inland Port on the M2/M50 junction. The re-allocation of space and more efficient use of the lands will see some none core port relates uses move outside the traditional port area. This is already a global trend seen in other European countries, China and the US. Additionally, this provides an excellent opportunity for investors/developers adjacent to the inland port.

The new agreement between the UK and EU this week will see the UK leaving the EU customs union. There will be a legal (not hard) customs border between Northern Ireland and the Republic of Ireland. But in practice, the customs border will be between Great Britain and the island of Ireland, with goods being checked at “points of entry” in Northern Ireland. Tax will get paid on these goods and they can then be transported into the Republic, or if they stay in Northern Ireland there may be a tax re-bate.

There will still be freedom of movement of individuals and personal goods. It is the tax on shipping goods into the Republic from the UK and back that could make many products produced here in the Republic un-competitive in the UK market. This is the single biggest issue facing the manufacturing industry and mainly food industry here in Ireland. It will be almost a requirement for manufacturers in the Republic needing to source their materials in the EU and shipping straight to the Republic, which may lead to the considerable increase of goods going through Rosslare Port. One way or the other, demand will continue for larger warehouse space and with every increasing emphasis on such space close to the main ports of Dublin, Cork and Rosslare.