Energy Performance of Buildings Directive

13th February 2024

On 7th December 2023, the European Parliament and the European Council reached a provisional political agreement on the Energy Performance of Buildings Directive which specifically tackles energy performance within buildings and sets targets for member States to achieve. Specifically, it addresses the following:

- Realignment and standardisation of the grading system of energy performance certificates, referred to as BER Certificates in the Irish market.

- Sets targets for the upgrading of existing buildings.

This directive was drafted after estimates suggested ‘75% of the building stock is inefficient’ within the EU and ‘85-95% of the buildings that exist today will still be standing in 2050’.

A clear template of considerations for energy performance certificates is stipulated in the directive. Similar to the current BERs, the evaluation includes kilo-watt hours (kWh) per square metre per annum (psm pa) but it may also include an extended set of indicators, which will ensure a comprehensive and more robust assessment of a building’s performance.

Unfortunately, details on how this may impact current BER ratings are still unknown. However, as renovations and new developments are completed, there will likely be higher standards and the criteria will become more stringent.

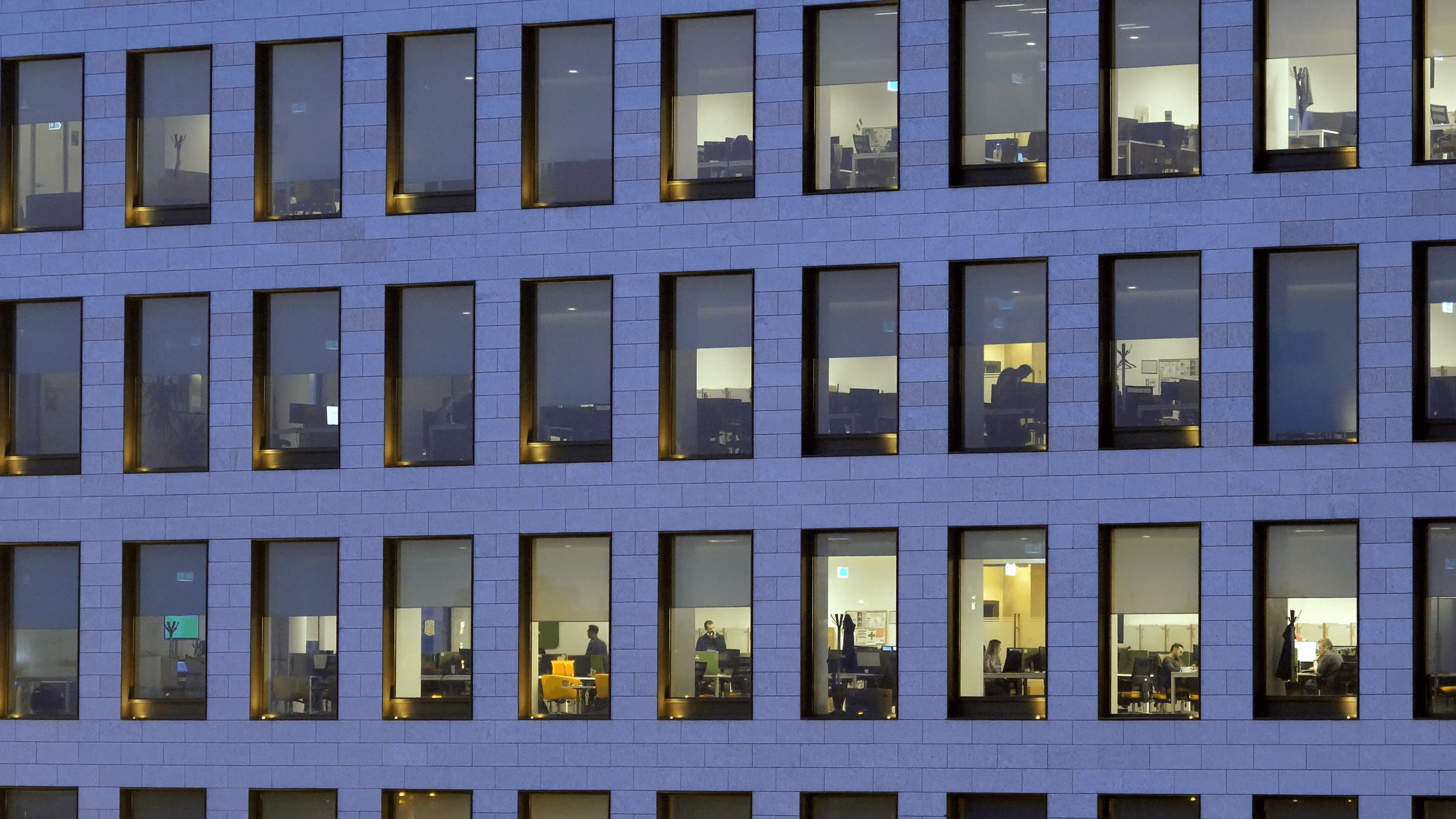

Stemple Exchange in Blanchardstown Corporate Park comprises two new buildings with a BER A-3 rating and ample electric vehicle (EV) charging points.

Targets have been set to renovate the 16% worst-performing buildings by 2030, and the 26% worst-performing buildings by 2033, to certain energy performance standards. This will result in one in four commercial buildings being required to be upgraded in less than 10 years. By applying this percentage to the Non-Domestic BER rating statistic for 2023, all G, F, E, and some D-rated buildings will require renovation. Again, the direction on how this will be implemented is vague and it remains open for each member State to decide how and who to incentivise or penalise to meet the targets.

Until this is clear, the impact on the commercial property market is unknown but it is likely to place an added liability on building owners. Most institutional investors are already unwilling to buy buildings where the BER is less than B or even A. This will likely filtrate to private investors and to smaller owner-occupied businesses. We anticipate this will negatively impact values, as the full capital expenditure or penalties will need to be accounted for in the next 5 to 10 years.

In addition, the directive places additional obligations on buildings frequently visited by the public. The directive states such buildings will be mandated to complete a regular energy certification. It specifies this requirement will extend to ‘schools, shops and shopping centres, supermarkets, restaurants, theatres, banks and hotels. These buildings may also be required to clearly display the BERs for public information.

Article 12: Infrastructure for sustainable mobility

An integral section within the directive, which could easily be missed, is the requirement for commercial buildings to provide EV charging points and additional future capacity by installing pre-cabling. New or substantially refurbished commercial developments (with more than 20 car spaces) will be required to:

- Install a minimum of one charging point for every five-car parking spaces (increases to one in two spaces for office buildings).

- Pre-cabling for at least 50% of car parking spaces.

- Provide bicycle parking spaces representing at least 15% of average or 10% of total user capacity.

The Energy Performance of Buildings Directive mandates EV charging infrastructure for commercial buildings.

For reference, substantially refurbished accommodation will be either (1) the total cost of the renovation is higher than 25 % of the value of the building, excluding the value of the land upon which the building is situated, or (2) more than 25 % of the surface of the building envelope undergoing renovation).

Existing commercial buildings (with more than 20 spaces) will be required to:

- Install a minimum of one charging point for every 10-car parking spaces (increases to one in two spaces for office buildings).

- Pre-cabling for at least 50% of car parking spaces.

- Provide bicycle parking spaces representing at least 15% of average or 10% of total user capacity.

It should be noted exemptions on bicycle parking can be introduced by member States on buildings that are not typically accessed by bicycles.

This will likely impact the market greatly as many landlords have yet to put any EV charging or ducting in place. We expect this to have a particular impact on older stock with larger car parking provisions. The timeline is extremely tight and may lead to a shortage of available suppliers and a surge in costs, given there are just three years to put these measures in place.

Article by Deborah Mahon, Divisional Director, Offices Department at Lisney.